Anyone who follows trends in freight and rates knows for sure that current trucking environment is one of the best in history from a demand perspective.

As the trucking industry plays a vital role for the US economy, there is a huge interest in what the new year will bring in the trucking industry.

The trucking industry outlook for 2022 focuses on few important topics.

Supply Chain

The US Freight Transportation Forecast to 2022 by the American Trucking Association and analysts HIS Global Insight and Martin Labbe Associates predict freight tonnage in the U.S. to grow 24% by 2022,.

The revenue in the industry will rise to 66%.

Survey provided by TruckStop.com and Bloomberg, shows “tightest trucking market in a generation” as 74% of truckers expect rates to rise or stay steady next year.

56% of respondents hauled more loads in the third quarter of this year than last year, 55% of truck drivers expect spot rates (excluding fuel surcharges) to rise in the next six months, and 74% expect rates will either rise or stay steady in 2022.

Those conditions are being triggered by forces including: steady demand due to restocking, structural shifts in e-commerce and peak-season preparation, and pent-up demand from increased port congestion, the researchers said.

Those factors will continue into the first half of 2022, reflecting the heavy demand put upon businesses and carriers.

Gas Prices

According to the EIA’s Short-Term Energy Outlook report, it`s expecting the U.S. retail price for diesel fuel to rise, then to steadily decline by the end of the next year.

Diesel fuel prices directly affect freight rates.

Diesel fuel prices have climbed gradually the last 12 months, rising from the 2020 national average low of $2.372 per gallon during the week ending Nov. 2, 2020, to the 2021 high-to-date national average of $3.734 per gallon during the week ending Nov. 15, 2021.

According to Tom Kloza, the head of energy analysis for Oil Price Information Service (OPIS), the biggest problem for fuel costs is the price of crude oil.

Kloza noted that the last time crude prices were this high – about seven or eight years ago – diesel prices were up but gasoline wasn’t as high as it is today.

That’s due in part to additional expenses in the supply chain.

DOE forecasts the national average for retail on-highway diesel prices to average $3.39 a gallon nationally in the first quarter of 2022, falling to $3.13 a gallon nationally by the end of next year.

Driver Shortage

Driver shortage continues to be a problem in the trucking industry.

The industry needs to find an average of roughly 96,000 new drivers annually to keep pace with demand.

If freight demand grows as it is projected to, the driver shortage could balloon to nearly 240,000 drivers by 2022, according to ATA data.

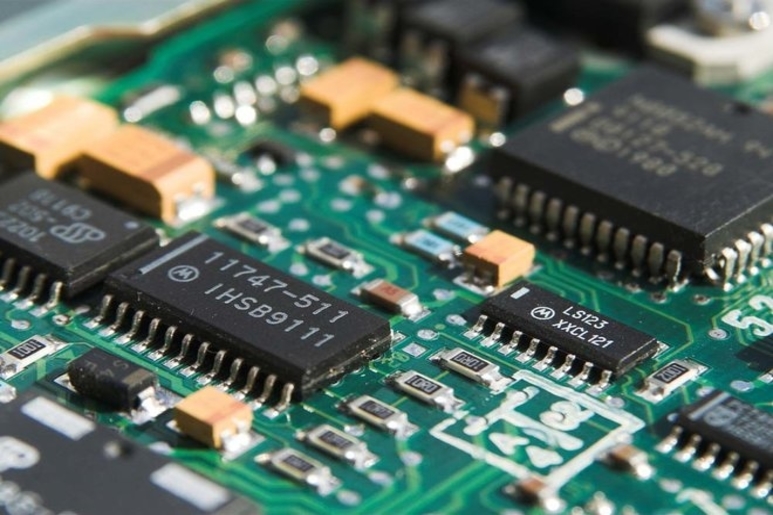

Semiconductor chip shortage

A global semiconductor chip shortage has slowed the production process of heavy-duty trucks.

In July, the production of large trucks used to transport goods, fell to its lowest level with 14,920 units manufactured.

Semiconductor production is managed overseas.

TrendForce department of Semiconductor research, reports that Taiwan holds 63% of chip production.

South Korea and China rank second and third for about 18% and 6%.

ACT research showed that the orders of trucks almost tripled to 262,100 trucks.

According to research analysis firm IHS Markit, it is expected this situation to come to closure around the end of March.

COVID 19 Pandemic

Up until mid-July, the COVID-19 pandemic appeared to be declining away.

But as vaccination rates reduced, the delta variant of the virus emerged in the U.S., increasing cases and hospitalizations.

There is no actual data that shows the delta variant is causing economic damage.

But there is also no reason to think that pandemic will be over soon, since there are new variants like Omicron.

This is going to be an issue for the next year, or for a prolonged period of time.

After the beginning of the pandemic, the US economy had more than 10 million job openings that is the most on record this century.

The Bureau of Labor Statistics had been tracking the metric since 2000.

Maintenance and Equipment Trends

The management at Corcentric have shared a list of some industry trends in 2022:

– Changes to parts, maintenance and repair

Sources are moving outside of the traditional OEM dealer network.

It is necessary to have a secondary service network for PM, tire maintenance, replacement parts, and extended maintenance procedures.

– Legislation of Safety measures

Aspect for legislation on safety-related components, including blind-spot warning, driver cameras, over-the-air speed trimming and assisted braking, among others.

– Emission standards

These standards require at least 25% lower carbon dioxide emissions and fuel consumption than a 2017 model year tractor.

Overall, the rule entails engines to reduce emissions 4.2% by 2024.

– Electric vehicles

Electric semi-trucks are coming to the roads.

Semi-truck maker Freightliner has a test fleet of 40 rigs, with availability in 2022.

Big truck makers MAN and Scania have started with almost $2 billion into electric truck R&D.

Volvo is actively putting its VNR Electric Class 8 trucks on the roads of Southern California at what it calls “an impressive pace right now”.

Tesla is still figuring out where to get enough batteries for them. However, it seems its electric semi trucks will be the first ones to hit the road according latest news.

– Tires

A shortage of natural rubber will lead to rising tire prices.

Tire manufacturers are implementing an “in-country” manufacture strategy to expand domestic volume to respond to global shipping limitations.

– Industrial Materials

Prices for copper, aluminum, iron ore, nickel, zinc, lead and uranium continue to rise.

In 2021, the metal price index is up 22% year to date.

Bottom line

Staying on top of market progresses allows the companies to make adjustments that can help fleets to run profitably.

This was the trucking industry forecast for 2022 by our trucking specialists.

Hope you like it and find it useful.