If you’ve been a truck driver for quite some time now, you might be thinking about transitioning one level higher, i.e., becoming your own boss.

Working for yourself will give you the independence, freedom, and flexibility you always wanted.

If you’re interested in getting rid of the shackles of the corporate world, you so can by becoming a lease purchase truck driver.

What Is a Lease Purchase Truck Driver?

A lease purchase truck driver is an independent owner-operator in the process of purchasing their truck by making use of lease payments.

Upon entering the program, you are treated as an independent contractor, i.e., owner operator, and you will be in charge of delivering freight.

During the leasing period, the lease program company can also assign you jobs – usually at a higher pay rate.

Apart from paying the lease payments on the truck you leased, you will also have to pay for fuel costs, provide insurance, and pay for your truck’s maintenance.

What Is a Lease Purchase Truck Driver Program?

The average cost of a used truck was estimated to be a little something over $40,000.

Now paying that amount of money right out the gate can be a tricky thing and not everyone will have them in cash. That’s understandable, but please, hold your tears! Nothing’s lost.

You can lease a truck from a company just like you can lease a car – through a trucking lease purchase program.

The reason why lease purchase programs are so attractive is because you don’t need any down payments.

Rather, you lease the vehicle and you pay for it gradually (on a monthly basis) for a few years.

Lease programs may vary in price and conditions; however, the monthly payments are usually lower and range from $800 to $2,500.

Note: Do not commit to a lease program unless you are ready to commit with the lease agreement, and/or trucking is what you want to do for a living.

Steps to Becoming a Lease Purchase Truck Driver Program

Research by FMCSA indicates that there are approximately 350,000-400,000 lease truck drivers in the US and that 6% of them are women.

What does this tell you?

That many have succeeded in their endeavor to leap into independence. All it takes is some patience and tenacity.

Here are the ultimate 7 steps you need to know to become a lease purchase truck driver:

1. Look for a company with years-long experience in leasing truck driver programs.

If you’ve decided to go solo and be your own boss, then this most probably isn’t your first trucking job.

That means you already have a circle of people that are in the industry, so ask around. Talk to other drivers, and you’ll eventually learn which companies have the best reputation for leasing.

Some companies will limit your profits by imposing you to pay them a certain rate per freight. Always look for a company that allows you to choose your own freights and freight rates because this will give you more than just the necessary freedom and flexibility; it will also maximize your profits.

2. Plan your finances.

Your finances impact your lifestyle and your quality of life. If you want truck driving to be your career path, know that your lifestyle needs to undergo some changes.

Before buying or leasing a truck, you need to assess your financial situation i.e., put your numbers in a spreadsheet to figure out what expenditures you will have when you are first starting out, what expenditures will appear in the next month, three months, one, to three or five years.

Projections are not going to be 100% accurate, but they are going to give you a roadmap to what actions you need to take constantly to stay afloat with your business.

Estimate how many routes you can take per month. Then calculate the total profit and deduct the costs (monthly lease payment, fuel, food, repairs, equipment, etc.) to see what you are left with.

Try to target excessive debt and eliminate it as well as come up with an emergency fund that will help you stay in safe waters when things get rough, and by rough we mean unplanned events and situations that will cost you money.

3. Choose a legal structure for your business.

To register your trucking business, you need to go to your state’s secretary of state website and run your company’s name in their database to see if your desired business name is available.

If you’re the only employee in the company, a sole proprietorship or a limited liability company (LLC) is the business structure you want to consider.

The sole proprietorship is the simplest business structure to form where the owner gets all the profit. However, if you register your company as a sole proprietor, in case of debt or bankruptcy, the bank is allowed to take your personal funds or property, wherein if registered as an LLC, you are free from the personal liability risk because your personal and business account are treated as two separate entities.

Once you’ve decided on a business structure, complete the application on the website, and pay the registration fee upon submission.

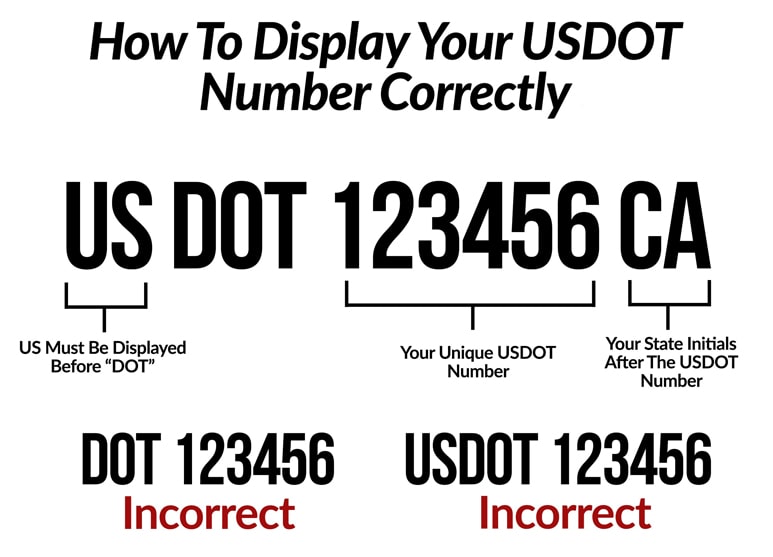

4. File for a USDOT number.

After choosing a legal structure for your business, you need to file for a USDOT number.

Your U.S. Department of Transportation (USDOT) number identifies you as a carrier operating in interstate commerce and it is assigned to you by the FMCSA. You can apply for your USDOT number through the FMCSA website.

The USDOT number is for all moving commercial vehicles hauling freight or transporting passengers across the interstate.

5. Get insurance coverage.

The average cost for commercial truck insurance in the US ranges from $640 to $980 per month.

Insurance companies have different rating criteria to calculate your monthly payment and there are many insurance types you can purchase to protect your vehicle: cargo coverage, physical damage coverage, roadside breakdown coverage, personal injury protection, etc.

More coverage means more protection, but it may not always be in the budget, right?

That’s fine – you can choose which type(s) of coverage to get.

6. Plan your truck’s maintenance.

Have regular check-ups & maintenance for your truck.

Don’t postpone paying your mechanic a visit because it may be too late. Before you know it, you are running being schedule.

It’s essential to find a store whose mechanics do a good job, so don’t just go to the very first store you find. Ask around, check reviews online. Be absolutely certain of your mechanic’s services before becoming their regular customer.

If you want to make long use of your truck, you need to treat it as a person. That means you need to regularly change the engine oil and filter, the power steering fluid, the engine coolant, the windshield washer fluid, and the brake fluid.

Actually, Ford recommends changing your truck’s oil every 7,500-8,000 miles., which means you should never postpone your truck’s maintenance and you should NEVER be stingy with oil quality.

7. Use load boards to find freight.

Once you are past the technicalities and bureaucracy, you can finally start browsing through load boards to find freight.

Don’t just use one load board, use as many as possible until you find regular clients.

Load boards help you find routes, negotiate rates, and stay on track with the necessary paperwork.

You can haul for different carriers, once you’ve finished the routes for your leasing company, of course.

At first, it may be hard to manage both, but over time, load boards can open the door to extra income, especially if you are in dire need of covering your expenses.

Things to Consider in a Lease Purchase

Truck repair costs can be over $15,000 annually for an average over-the-road truck that has passed 100,000 miles.

If you are not the first owner of the truck, make sure to tackle its history of repairs, the mileage, or whether the truck has been previously leased. You want to make the most of your investment; you don’t want it to make the most out of you.

Make certain that there is freight available and check load boards for regions and routes that the lease company wants you to haul, just so you are one step ahead and know what’s awaiting you in terms of infrastructure, weather conditions, route length, etc. Preparation is key.

Another thing to consider before leasing is the type of freight you will be hauling. On average, flatbed loads are the highest paying truckloads because that’s usually heavy machinery or construction materials, but you can also haul dry van i.e., food and beverages, household goods, clothing items, plastic, etc.

Due to higher demand, most drivers haul dry van.

Pros and Cons of Lease Programs

Pros:

Less commitment. If you purchase a truck, you have to go through the process of selling it rather than just ending your lease should you decide that trucking isn’t your cup of tea. Lease programs are a dandy solution, especially for drivers that are just starting out, and don’t want to make a definitive career choice just yet.

Lower risk. You know the amount of your lease payments and you pay the money gradually. Lease programs are a huge plus thanks to their payment flexibility. After all, not everyone has thick savings and not everyone can get that big of a loan to buy a truck, right?

Lower upfront cost. By leasing a truck, you can start working much sooner than actually saving to buy one. Applying for a loan can sometimes take longer than expected, while some leasing companies offer tax deductions and allow you to lease a truck without the prior first payment.

Besides, independent leasing companies allow you to choose a lease option that best fits your needs, and in case you don’t know which option is best for you, you can consult an expert.

Cons:

It’s not your vehicle. Since the truck ownership won’t be yours, you can’t really change the truck you leased as you potentially would’ve had it been your own.

Lack of control. Some companies may require extra coverage to protect their assets and some trucks may be old and over-used, so you can end up paying a lot more than expected to fix the vehicle and put it into a working process.

It’s strongly advisable to carefully read the lease agreement before you sign it because if you lease from the company you work for, you may not be eligible for health benefits.

Also, even though the amount you need initially to purchase a truck is hefty upfront, if you don’t end up buying the truck by the time your contract expires, it might end up costing you an arm and a leg.

Lease Purchase Truck Driver Agreement and Salary

Lease program agreements are usually between one and three years. After the contract is up, you have the option to purchase the truck (the monthly payments you have been making are going to be applied to the total purchase price), start up another lease program with the company, or walk away and choose a different company.

Know that most companies will not allow you to walk away from a lease agreement whenever you want, so before signing up for a program you have to be certain that you can commit to the given time frame.

On the flip side, after your agreement expires, the amount of money that you will have to supply to get complete ownership of the truck will be significantly fewer thanks to the lease contract.

According to ZipRecruiter, as of July 12, 2021, the average annual pay for a Lease Purchase Truck Driver in the US is $110,447 a year or $53.10 an hour, which equals $2,124 per week.

Additionally, the trucking industry has an average profit margin of about 3%, which means that on average, a lease driver will make about 3% more than a company driver.

The Takeaway

The trucking business has always been an extremely competitive industry and following the aftermath of COVID-19, it has made an even bigger popularity-demand splash.

When you are a lease purchase truck driver, you design your driving experience, you make a lot of the choices, and you carry the responsibility. Practice taking action. Practice taking the lead on your loads and don’t forget to double-check your contract, your truck’s functionality, and equipment BEFORE leasing the vehicle.

Everything you do, do it with cutting costs in mind. Successful truck drivers are the result of channeled patience, thorough strategy, and an entrepreneurial mindset, after all. That’s all you need to make the first step. After it, everything becomes so much easier.

Don’t forget that we can always help you decide and guide you through the process of becoming a lease purchase truck driver. Just give us a call and we’ll get you in as quickly as possible.